13th January 2016 - Lessons from Peterborough – the first Social Impact Bond

The Ministry of Justice has recently published the final process evaluation report for the social impact bond at Peterborough prison. There is a wealth of content in the report that will be of interest to people working in this policy area, but there are also a couple of quotes of more general interest to those involved in social investment and social impact bonds:

-

“[B]eing on a project that’s so innovative and where you can come up with ideas that you go back to the funder and then things can happen, you know, when you normally have a contract and you’ve got a set amount of money you can’t really be that creative unless you’ve put it in the budget in the beginning. So that’s been really good and we’ve developed lots of kind of models of working and new ideas that we’d like to replicate… that’s been really beneficial to us. ” The report goes on to say that this isn’t a feature that requires a SIB, it was not typical of other funding arrangements.

-

“I think just the way the project has evolved […] I mean it has changed every year […] we used statistics and data to help work out what works and what’s needed and we’ve been able to respond to that and be creative and so that’s been really great.”

Both of these points chime with comments from people working on delivering other social impact bonds – and it's worth considering the fact that although neither of these of these points are impossible to achieve in traditional contracting arrangements, they both go against the grain of output-based commissioning (i.e. commissioning someone to deliver a particular defined service), while they are required for payment-by-results commissioning and social impact bonds.

The report also touches on a point of contention within the social impact bond community: should providers have any performance-based payments? This one did not, and the report strongly implies that this is the correct way of doing it. Yet in other social impact, where performance-based payments are made to providers, the providers themselves are equally adamant that it is the right way – that it gives a healthy focus and impetus to team discussions and makes the gathering and analysis of statistics much more interesting. Investors are similarly polarised in their views on whether it is a good or bad thing. Certainly a point that will be debated more as the social impact bond market develops.

Comments

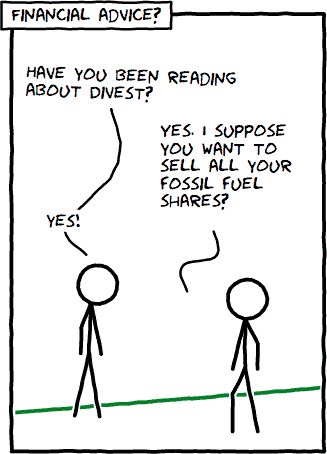

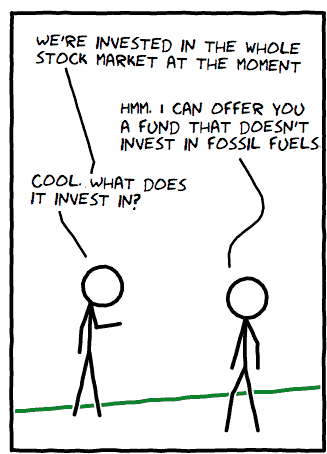

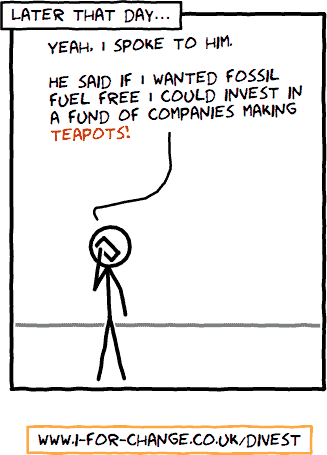

24th August 2015 - Finding straightforward fossil fuel free investments is hard.

If you invest directly or indirectly in mainstream investment funds or ETFs, there is a lack of choice in products that are fossil free. In effect, you may be forced to change investment strategy much more radically than simply divesting from fossil fuels.

Comments

15th July 2015 - Social Investment at scale: $150m invested, $3.3bn returned

Is this the best social impact investment, ever? $150m invested, $3.3bn returned – and significant impact http://t.co/F7LWLe1kcs #socinv

— i for change (@iforchangeUK) July 15, 2015In the UK we still think of social investments as quite small: some organisations will look to raise less than £100,000, and ones looking for more than £5m are still quite rare. So it's in that context that it is fascinating to look at what happened recently in the US: the Cystic Fibrosis Foundation helped fund a drugmaker, Vertex, to work on Cystic Fibrosis medication, in exchange for a share of royalties for any drugs coming out of the research. Vertex went on to develop Kalydeco, a drug that can treat the underlying cause of cystic fibrosis for a small number of patients - and a couple of years later, the Cystic Fibrosis Foundation sold their share of the royalty rights for $3.3bn.

Now this is interesting for two reasons: firstly because it demonstrates that social investments don't have to be in charities and social enterprises – with the right financial structure they can be with a much more conventional corporate. The second reason is that we don't always have to think so small: where a compelling financial case can be made, investments can be orders of magnitude bigger than the ones we have become used to in the social investment marketplace.

This news story from Bloomberg has more details about the development of Kalydeco: http://www.bloomberg.com/news/features/2015-07-07/this-medical-charity-made-3-3-billion-from-a-single-pill

Comments

16th January 2015 - Social Angel Investors: It’s All About Passion

Great seeing so many people gathered for social angel investment at @cabinetofficeuk's Downing St event last night. #socinv

— i for change (@iforchangeUK) January 16, 2015

It was fascinating being at an event for social angel investors last night, organized by the Cabinet Office, and held at 11 Downing Street. Not only the occasion of being in Downing Street, which was interesting enough, but talking to such a diverse bunch of people, unified by their interest in investing in small social enterprises.

Many had never really thought of themselves as “social angels”, they just saw themselves as angel investors who were interested in projects with a social dimension. Almost universally, they were used to looking at social enterprises as if it were an ordinary business from the standpoint of the finances, the governance, the business plan. Almost no one seemed to care about specific social impact metrics, or social return on investment, or any other parts of the jargon-laden quasi-academic analysis of social impact that is common in this area. That's not to say that people didn't want it to be done, just that they weren't (in general) so concerned about the details – what they cared about more was passion: management of the social enterprise needed to be passionate about what they did and why they did it.

Comments

17th July 2014 - Youth Engagement Fund: Early interaction with social investors

The Youth Engagement Fund is a £16.04m outcomes fund that aims to help

The official objectives are fourfold:

Deliver support to help young people aged 14-17 who are disadvantaged, or at risk of disadvantage to enable them to participate and succeed in education or training, improving their employability, reducing their longer term dependency on benefits and reducing their likelihood of offending.

Enable schools, academies, local authorities, colleges and others to use their resources more effectively to support disadvantaged young people and reduce the number of young people who become NEET (not in employment, education or training).

Test the extent to which a payment by results approach involving social investors can drive improved outcomes for young people and generate benefit savings, as well as other wider fiscal and social benefits.

Support the development of the social investment market, build the capacity of social sector organisations and contribute to the evidence base for social impact bonds.

There are a few particularly interesting points about this fund from a social investment perspective.

Like the Fair Chance Fund, it is quite prescriptive in the types of social investment that will be allowed. In this case it only allow Social Impact Bonds, and even then only a restricted type of social impact bond.

Another unique feature is how early on in the process investor engagement and financial structuring need to happen. This includes decisions on who takes which risks, and how the legal structures and money flows will work. Both of these elements need to be in place before the “Initial Application Form” is submitted, which had a deadline of 18th August 2014.

Full details of the background information and how to apply can be found on the DWP procurement website, which requires users to register before viewing the documents.

Comments

18th December 2013 - Caution on Open Data for Social Investment.

The Cabinet Office recently published some data on social investments made by charitable foundations in the UK, along with some interesting visualisations.

It looks really quite interesting, but before getting too excited about the output, I decided to look into the data a little more carefully. I wanted to see how consistent data entry was. Given that social impact bonds are a core area, and all three of the participating foundations had been involved in the Peterborough Social Impact Bond, that seemed a natural choice to look at in more detail.

What you can see in the table below is, unfortunately, a lot of inconsistency in the data.

| Foundation | The LankellyChase Foundation | Panahpur | The Barrow Cadbury Trust |

| Source Of Investment | WC1R 4BH | tn9 1ap | WC2B4AS |

| Investment date (commitment for investment/ facility/ guarantee) | 27 October 2010 | 10 November 2010 | 10 November 2013 |

| Investment date (cash draw down) | 1 November 2010 | 10 November 2010 | Split over 6 dates |

| Original scheduled final full repayment/ redemption date | 1 November 2018 | 20 November 2013 | 20 November 2019 |

| Commitment or facility provided - amount guaranteed or underwritten | £- | £100,000 | £100,000 |

| Cash invested - principal invested/ amount guaranteed or underwritten | £500,000 | £54,193 | £54,193 |

| Total Value incl. co-investment | £5,000,000 | £5,000,000 | £4,200,000 |

| Payment Frequency | Other | Annually | Other |

| Bullet Payment | Yes | No | Yes |

| Balloon Payment | Yes | No | No |

| Product Type | Bonds | Equity | Equity |

| Purpose Of Investment | Working capital and cash-flow finance | Working capital and cash-flow finance | Working capital and cash-flow finance |

| Location Of Investee | UK,W1W5BB | UK,W1W | |

| Geography Of Beneficiaries | PE3 7PD | PE | |

| Sector | Criminal Justice and Public Safety | Criminal Justice and Public Safety | Criminal Justice and Public Safety |

| Type Of Organisation Invested In | Limited Partnership | LLP | Company limited by shares |

| Charity Number | |||

| Company Number | LP013829 | 7240908 |

Now to be fair, this is a complicated investment structure, and investors could enter it via different routes (with a partnership interest or through a corporate feeder structure), so some of the differences are explicable – if not terribly useful when you are trying to draw meaning from this style of data.

What about the analytics? Well there does appear to be some double-counting, but not nearly as much as there might have been: for example, the visualisation (derived from http://data.gov.uk/data/viz/social-investment-and-foundations) appears to show that these three foundations invested £608k and others invested £8.6m in this social impact bond, where I suspect true figures should be more like £379k with others investing around £2.3m. (These latter figures are estimates based on a few assumptions: if you know better, feel free to correct me.)

As a self-confessed data-geek, I fully appreciate that it is hard to get perfectly clean data – particularly on the first go. And I applaud the Cabinet Office and the contributing foundations for the time and effort in getting this far. But if we are to try to draw meaningful information and trends from this data we have to, collectively, do a little bit better.

Update: 4th Feb 2014 - The Cabinet Office wrote to me on 20th Jan 2014 to say that they had removed one of the inconsistencies - updating Barrow Cadbury's reporting of the Total Investment into the Peterborough SIB from £4.2m to £5m. Since the code behind the visualisations on the Data.gov website assume that all deals with the same total investment size are actually the same deal(!) this does address the double count in this instance. It doesn't, however, resolve some of the other issues – for example the revised chart now shows that the three foundations contributed £608k of the £5m in the Peterborough SIB; in reality this is mixing commitments to invest with drawdowns actually made – it is known that these three foundations collectively committed £700k. This could be fixed in the data set too, but the point is not to say that there is one piece of data wrong - this example was picked as one that was easy to validate as there is so much public information on the deal - the point is that we have no idea as to the data quality of the rest of the data set.

Comments

28th October 2013 - An interview on social impact bonds.

The interview may be found here.

Comments

26th September 2013 - £3m grant for Local Authorities Creating SIBs

Nat Sloane, @BigLotteryFund @Big_SI_England : our role is as catalyst; we can look beyond an electoral cycle #sioutcomes

— i for change (@iforchangeUK) September 26, 2013

Nat Sloane @BigLotteryFund : lots of technical elements in structuring deal, social outcomes that need to be achieved http://t.co/nzEpFXNnxf

— i for change (@iforchangeUK) September 26, 2013

The Cabinet Office’s Social Outcomes Fund and the Big Lottery Fund’s Commissioning Better Outcomes fund have a joint mission – and £60m – to support the development of more social impact bonds and similar investments.

The Local Government Association (LGA) and Social Finance have been appointed by the Big Lottery Fund to assist those interested in developing a social impact bond to put together an initial proposal and submit a formal Expression of Interest to these two funds. As part of this, public sector bodies (generally local authorities) - can ask for between £10,000 and £150,000 of development funding to purchase technical support to develop a social impact bond.

iforchange is on the database of suppliers of technical assistance for organisations that successfully pass the Expression of Interest stage. Technical assistance after this stage could include, for example:

- Building the case for outcomes and ensuring they are the right outcomes for the social issue that is being addressed; refining or changing outcome metrics where relevant.

- Financial modelling: understanding how different payment structures could impact both the public sector body and external social investors. How to optimise payment structures to achieve better value for money.

- Legal contract refinement – understand the trade-off between reduced legal risk and cheaper tenders. Entering into contractual negotiations with a clear understanding of these issues can mean that lawyers can be instructed more effectively, and contractual negotiations can be concluded more rapidly, resulting in swifter and cheaper contract negotiations.

Although the LGA and Social Finance will be in place to assist with submitting Expressions of Interest, please do feel free to contact us too for an independent point of view without obligation.

Comments

23rd September 2013 - Our founder, Russ Bubley, quoted by the FT

Our Founder, Russ Bubley, is quoted by the Financial Times, in an article on social impact bonds. In this quote, he is discussing the first social impact bond transaction in the US which was invested in by Goldman Sachs. This transaction had a guarantee from the Bloomberg Philanthropies, limiting any loss that Goldman Sachs could make on their investment.

“Having a name like Goldman Sachs on board is a significant landmark, says Russ Bubley, an ex-Citi banker turned social investment strategist. But he says investors in the British SIBs have had to be much bolder without the safety net of someone like Bloomberg.”

The full article can be viewed on the FT website (paywalled).

Comments

17th September 2013 - Social investments at scale need FLAIR: Lessons from Lloyds.

Today it was announced that UKFI, the company set up by the British Government that owns all sorts of bailed out assets stemming from the financial crisis, had sold 6% of Lloyds Bank for £3.2bn. From first announcement to actual sale took less than half a day. And, according to the press, there was interest in £9bn of shares. For those of us working in social investment, where even a successful deal can take a month to raise a few million pounds, these amounts of money and the time-scales involved seem truly staggering.

The most important lesson for social investment has to be that the money is there for the right investment. And it is there in enormous size. It’s just not straightforward to access it.

So what is it about the Lloyds sale that was so different to social investment capital raising? FLAIR.

Format

Investments have to be in the right format for investors to want to buy them: they must have a format that works for the investor from a legal, tax, operational and regulatory perspective. Investors want to be able to buy, hold, and sell investments cheaply, easily, and efficiently.

Liquidity

For many investors, the ability to sell the investment again is an absolute necessity: they may be constrained by regulation or policy from holding investments that they cannot sell, and there can be accounting implications too. Even for individuals this is an issue – people like to know that in an emergency they have some way of realising cash from an investment. In the social investment space, providers like Ethex are helping to bring liquidity to social investments.

Access

When it came time to make the sale, the banks involved would already have known who to call, and have had the right working (and contractual) relationship set up.

In addition, even before making the calls, they would have had a good idea which institutions would most likely be interested in buying – in the weeks and months leading up to the sale, they would have been having conversations assessing interest in a sale should it happen.

Information

Lloyds is a public listed company – which means that there is plenty of publicly accessible information about the organisation available – and moreover that information will continue to be available. Investors abhor a lack of information – they feel they cannot make rational decisions without plenty of information and transparency, and the knowledge that the information flow will continue in to the future. They particularly abhor information asymmetry (whether real or perceived) – the fear that someone else knows more than they do and can therefore make better decisions than they can.

Rationale

Beyond information being available, investors have to feel they understand it, and there is still a compelling reason to buy. In this case, there is nothing novel about the structure of the investment or the company. The value of the company was being continuously assessed externally, and they were being offered shares at a discount to where they had been trading that day. For novel investments, or investments where there is a claim being made of a social benefit, the investor will desire crystal clear arguments as to why the investment makes sense.

Comments

9th July 2013 - The Big Lottery Fund’s Commissioning Better Outcomes Fund.

The Big Lottery Fund’s Commissioning Better Outcomes Fund: extra £40m to catalyse #socialimpactbonds @BigLotteryFund http://t.co/ApgcfWsCKW

— i for change (@iforchangeUK) July 10, 2013

Nick Hurd's social investment plea: “Let us fight the jargon. Keep this human. Keep this real.” @minforcivsoc http://t.co/ApgcfWsCKW

— i for change (@iforchangeUK) July 10, 2013

The Big Lottery Fund announced today a £35m new fund to further catalyse the development of social impact bonds in England. It will run in parallel with the existing £20m Social Outcomes Fund, run by the Cabinet Office, and will share the same application form.

In addition £2m will be spent on providing support to commissioners on questions such as “Does a social impact bond make sense for what is trying to be achieved?”

Lastly, £3m will be made available for “technical assistance”, if a commissioner wants to purchase in support to structure and develop social impact bonds.

The new fund has a more targeted aim than the Social Outcomes Fund – it is aimed at helping people most in need, and seeks to provide additionality by not funding any services which government has a statutory duty to provide. Although it may be used for other purposes one aspiration is to fund social impact bonds with impacts that span central and local government. The Big Lottery Fund also state that this fund aims to ensure that voluntary, community, and social enterprise organizations have a chance to be involved; given that the gateway to these funds is envisaged to be via a public sector commissioner, it is unclear how this will be achieved within the tendering rules.

Speaking at the launch event, Nick Hurd, Minister for Civil Society, said that “The Big Lottery Fund can do what government can’t do and really look at the long term.” Describing social impact bonds, he highlighted that these types of contractual arrangements create the space for innovation.

The Big Lottery Fund’s press release can be found here.

Comments

23rd May 2013 - The name’s Bond. Social Impact Bond.

For some reason there seems to be some confusion over the word “Bond” when people are discussing Social Impact Bonds.

Various pundits have said that a Social Impact Bond is not a bond, because bonds have a fixed interest rate and repay your capital. That’s that sort of bond that many individual investors commonly invest in.

But it’s not the only type of bond there is.

There are perpetual bonds which never repay your capital; floating-rate bonds, where your interest depends on a benchmark index; inflation-linked bonds, where interest and capital depend on the inflation rate; convertible bonds, issued by a company, where either the holder (or in some cases the company) can force the bond to be exchanged for shares; structured investment bonds, where interest and/or capital repayments are linked to the performance of the stock market. And so on.

So what then is a “bond”? The venerable Oxford Dictionaries gives several definitions, but the relevant one is “a deed by which a person is committed to make payment to another.”

Implicitly, the amount of the payment must be calculable and not discretionary. It is a type of debt.

So is a Social Impact Bond a bond? Absolutely. Is there a dangerous risk of confusion from the term? There certainly shouldn’t be – as with any investment product, if you don’t understand it you should seek assistance.

iforchange can deliver training, workshops, seminars, and consultancy on all aspects of social impact bonds and other forms of innovative impact finance.

Comments

11th December 2012 - London Homelessness Social Impact Bond

Happy to have completed for panel of investors in the @stmungos #socialimpactbond for London homelessness. First retail SIB investors?

— i for change (@iforchangeUK) December 11, 2012

The London Homelessness social impact bond, commissioned by the GLA with St Mungo‘s as a service provider completed today. We are delighted to have led a panel of investors into this deal. We believe that we have enabled the first ever individual investors (retail investors) to take part in a social impact bond investment; previous social impact bonds have received funding exclusively from organisations and high net worth investors.

Interested? Do get in touch: [email protected]

Update: 12th Dec 2012 - The Guardian has an article about this social impact bond.

Update: 13th Dec 2012 - Article in Civil Society.

Update: 14th Dec 2012 - More articles, from Charity Times, and Third Sector.

Update: 23rd Feb 2013 - And an article from The Economist

Comments

23rd September 2012 - Social Outcomes Fund

At launch of £20m #socialoutcomesfund. Fund will provide extra outcomes money above that from LAs in new #socialimpactbonds. Runs till 2018.

— Russ Bubley (@RussBubley) November 23, 2012

I asked Nick Hurd if #socialoutcomesfund is instead of or in addition to money from Depts, Answer was that it will be simpler and faster.

— Russ Bubley (@RussBubley) November 23, 2012

The Social Outcomes Fund is aimed at easing the burden on Local Authorities when new Social Impact Bonds are created. Frequently, the types of innovative services delivered by a Local Authority under a Social Impact Bond Programme will have impacts that extend beyond the statutory provisions of the Local Authority – and produce additional beneficial impacts to other public bodies, in particular to central government.

Negotiating with central government can be an onerous task - especially given the relative novelty of social impact bonds. In the development of the Essex SIB – which deals with children on the fringes of residential care – the negotiations with central government took nine months.

Comments

11th September 2012 - Impact Investments and Ethics

Impact investments may be ethical, but many peddling them are not. Misleading descriptions and hidden gotchas abound. Caveat Emptor!

— Russ Bubley (@RussBubley) September 11, 2012

Ethics covers a wide area. Ethics in impact investment shouldn’t just be about where your money goes and what impact is has, but also about what investment you have been sold.

Impact investors are seen by some as a soft touch: there is a dangerous assumption that impact investors won’t be as careful in evaluating investments – they will be much more trusting of what they are being told. As a result, all sorts of details may conveniently be forgotten. Details like:

-

There are other (mainstream) investors who are not investing for impact and are getting better economic terms for the exact same deal. I’ve seen examples where money was being lent both by banks and impact investors. The impact investors were getting a worse rate of interest, and the banks were getting security on their loan.

-

Impact investors are generally optimistic about the impact they will have, so we don’t need to bother explaining what happens if things go wrong. I’ve seen examples here where the worst case presented didn’t show the investor taking a loss, even though that was perfectly feasible (e.g. the delivery partner fails to deliver, or the property market actually goes down). One was at least slightly amusing – in explaining that an investment was not guaranteed by the FSCS but instead involved lending money to a social housing provider, they described this loan as “safe as houses”!

We can slap on more costs for impact investors, because we can point to the impact investment label – even though we know perfectly well that the investor can have the same impact on better economic terms elsewhere.

Comments

18th July 2012 - New Social Impact Bonds - July 2012

The Big Lottery Fund is funding new social investment projects,including four #SocialImpactBond projects plus more. news.biglotteryfund.org.uk/pr_180712_eng_…

— Russ Bubley (@RussBubley) July 18, 2012

We are delighted to be involved in advising one of the service providers in this new round of Big Lottery Fund projects.

Comments

23rd March 2012 - Public Services (Social Value) Act

Public Services (Social Value) Act is great news for selling #SocialImpactBond to local authority pension funds in UK bit.ly/GQFgCE

— Russ Bubley (@RussBubley) March 23, 2012

The newly launched Public Services (Social Value) Act says (among other things) that public authorities must, prior to tendering for services, consider “how what is proposed to be procured might improve the economic, social and environmental well-being of the relevant area”. Local Authority pension funds fall under these rules, so a straightforward reading of this act implies that when contracts to manage investments for Local Authority pension funds are made, some regard will have to be made to investments that help the local area, for example, social impact bonds and other forms of local social investment.

Comments

22nd March 2012 - Risk Transfer is Good!

Some Local Authorities understanding that getting rid of economic risk is good. guardian.co.uk/business/2012/… . Good for #SocialImpactBond s too!

— Russ Bubley (@RussBubley) March 22, 2012

The Guardian reports that some councils have been entering into weather derivatives – so that if we have unseasonably cold weather, they will get a payout to fund extra road gritting; conversely if we have fewer icy nights the councils will need to make a payment. This is all about mitigating budget risk by transferring costs away from the council. Conceptually this is very similar to the risk transfer that is the goal under Payment by Results contracts and for Social Impact Bonds.