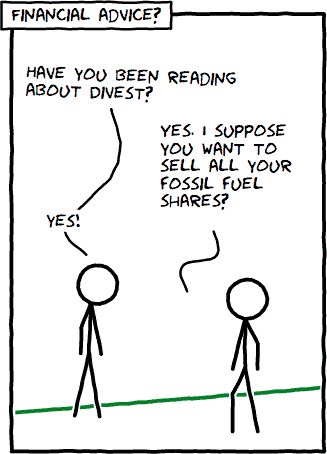

Many charitable trusts, family offices, and other organizations are responding to the fossil fuel Divest campaign, and the Divest:Invest movement. Yet actually transitioning from a mainstream investment portfolio to one that excludes fossil fuels is quite difficult in practice. And if you want to layer on other divestment considerations, e.g. avoiding armaments companies, or excluding companies that would conflict with tax justice policy work, it becomes harder still.

If you invest directly or indirectly in mainstream investment funds or ETFs, there is a lack of choice in products that meet various exclusion criteria. In effect, you may be forced to change investment strategy much more radically than simply divesting from your target areas. (The problem with divesting.)

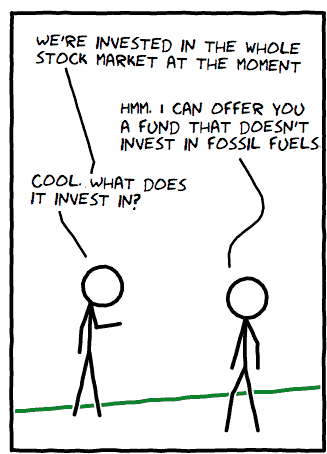

By way of example, suppose 30% of your mainstream investments are currently invested in a fund or ETF that is benchmarked to the FTSE – there are not (as far as we are aware) any funds to invest in that maintain a broad UK market exposure, and just exclude fossil fuels.

If you are a charitable trust or foundation, we can arrange passive investments that are tailored to your needs: following major share indices like the FTSE, but excluding sectors or companies that run counter to your mission or your views.

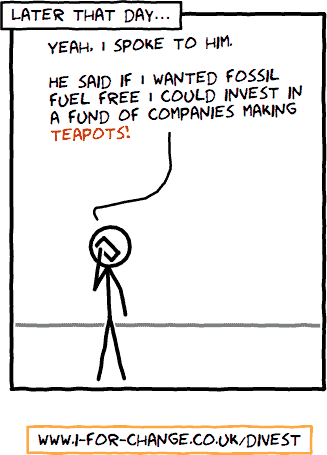

Some people feel that just divesting from fossil fuels is not enough – that the portion of their investments that have been divested should be reinvested so as to make a positive change. We also advise clients who are interested in this type of social or impact investment, please contact us for details.

If you are interested, then please enter your contact details (or send us an e-mail: [email protected]), and someone will be in touch.